What is PAMM?

Caibull MT5 PAMM stands for Percentage Allocation Management Module — an advanced investment solution designed to benefit both investors and money managers through a shared capital pool. Investors gain access to professional trading strategies, while money managers are able to trade larger combined capital and earn performance-based fees. All trading activity is executed exclusively on the MetaTrader 5 (MT5) platform.

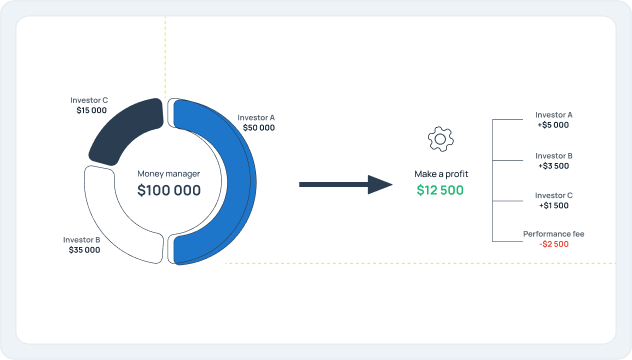

Under this model, multiple investors allocate funds to a designated money manager’s MT5 trading account. The total capital is pooled and actively traded by the money manager using their strategy and expertise. Profits and losses are automatically calculated and distributed proportionally to each investor based on their share of the total pool, while money managers receive compensation according to the agreed fee structure.